We are EliteHealth.Group powered by Synergy

We help you get more out of life

Through science-led supplements and vitamins based on Nobel-prize winning research.

Helping people feel and function better from the inside out, through

Sports Nutrition, Gut Health Purification, Heart Health programs and General Nutrition

We are EliteHealth.Group powered by Synergy

We help you get more out of life – with science-led supplements and vitamins based on Nobel-prize winning research.

Helping people feel and function better from the inside out, through

Sports Nutrition, Gut Health Purification , Heart Health programs and General Nutrition

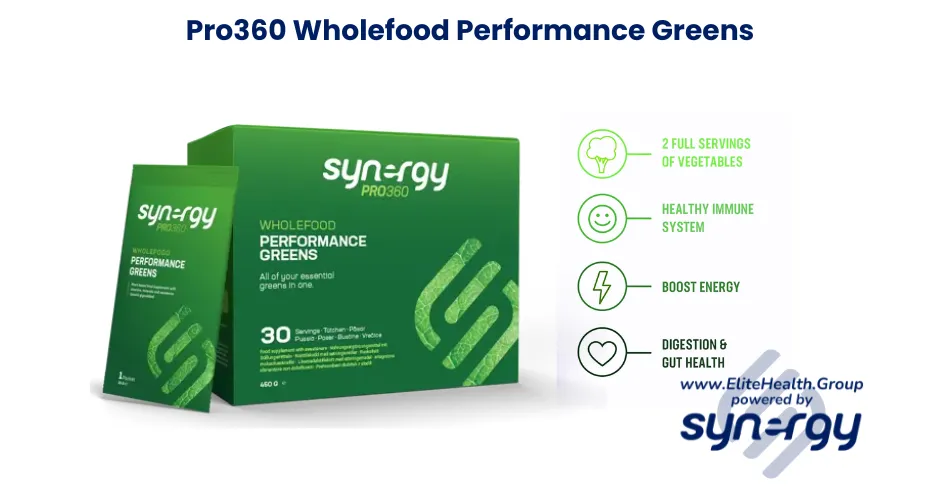

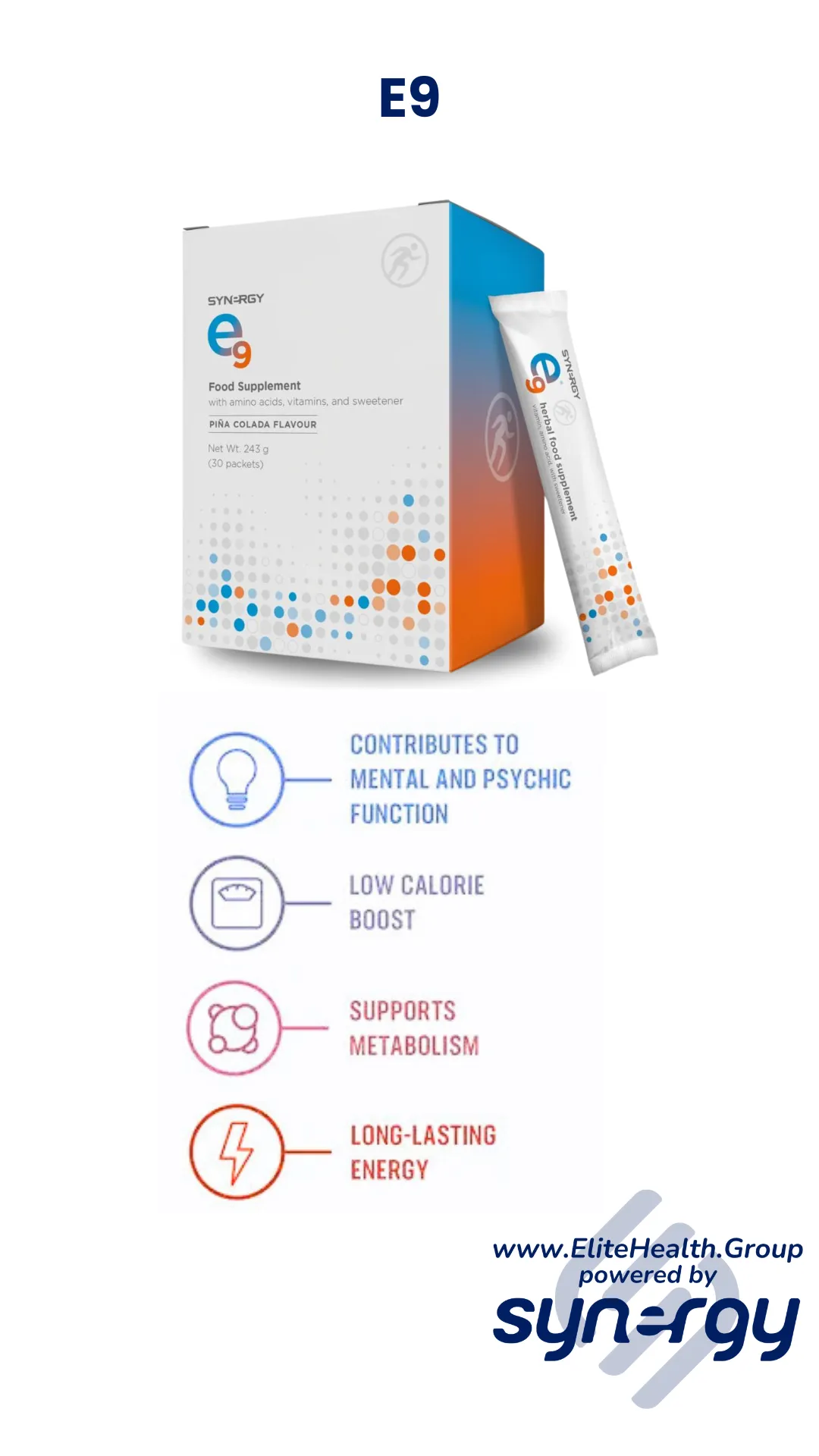

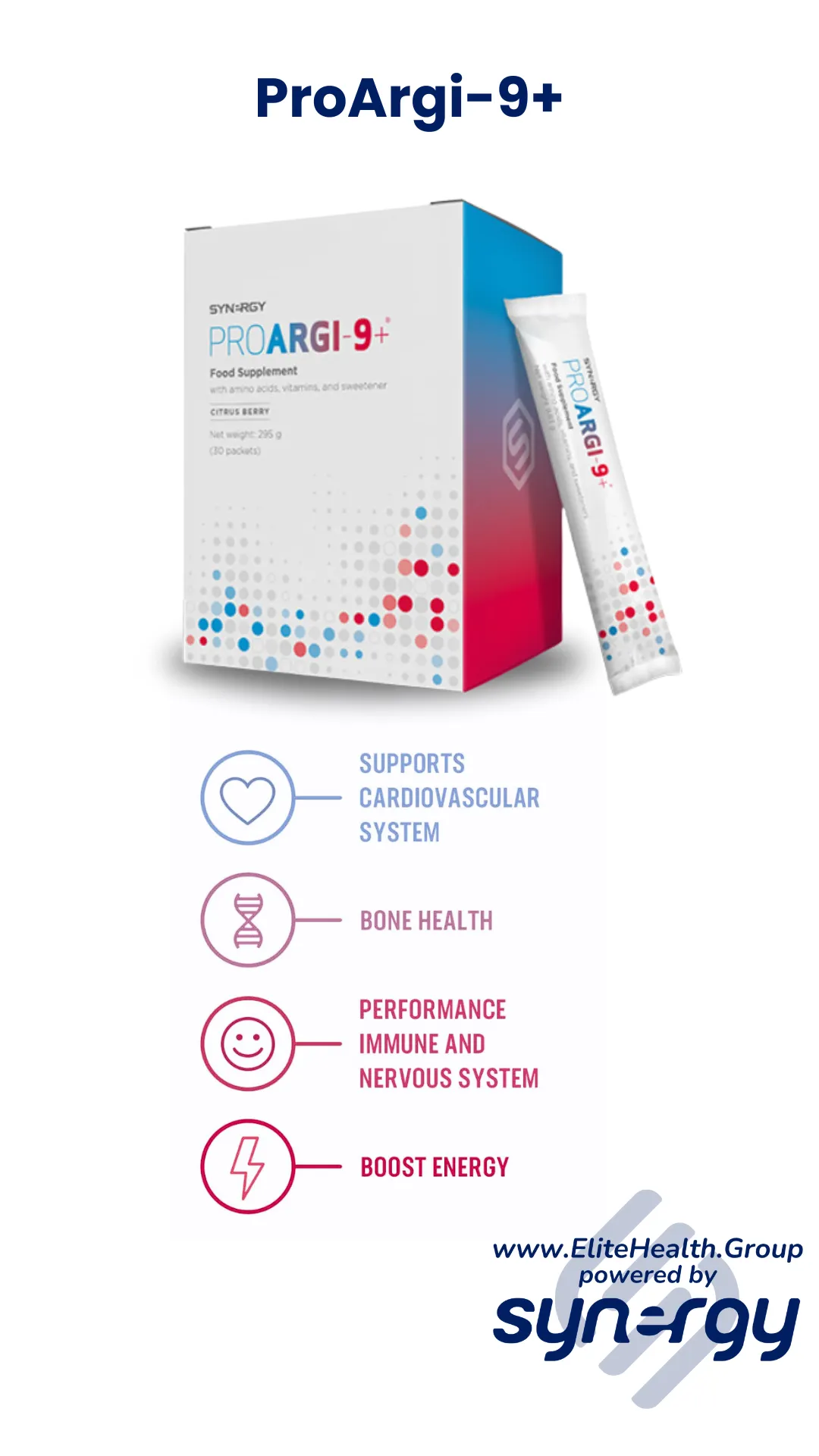

Our non-negotiable supplements

We personally feel and understand the benefits of taking these suppliements each and every day. Benefiting our bodies through the gut, heart and brain.

That's why they are our non-negiotiables!

Try them yourself. We're so confident you'll love them, that you get a 90-day money-back guarantee

Scroll through to see the benefits

Get your performance power pack for £239.99*

Enjoy the health benefits of these products, supporting your gut, immunity, energy, cardiovascular system, through to mental focus and metabolism.

Create a partner account and get your pack for £199.99*

With your partner account, you'll not only benefit from wholesale prices, but you'll also open an amazing income opportunity while helping people live healthier lives.

Our 90-day money back guarantee

At Synergy WorldWide we are passionate about our products, quality and customer satisfaction.

We believe in our products and are confident you will love them too. Our 90-day money back guarantee is valid for all first-time purchases, when redeemed within 90 days after the purchase date. This makes trying our Synergy products simple & easy.

*prices correct as of 1st Dec 2024

Check out our other packs / programs

Got a question for us?

TESTIMONIALS

What others are saying

"Could not believe it"

"My father had a whooping cough and pneumonia 2x in the last 12 months and life threatening accident, taking Synergy's performance greens and Beets together with Proargi meant he didnt end up in hospital even though he was predicted to not survive, he had recovered so fast and so well that the doctors could not believe it.

"Balancing family and fulfillment"

"by becoming a Synergy Worldwide partner, it has given me the flexibility to build a career around my family, share products I trust, and create a lasting legacy for my loved ones"

"Highly recommend this"

"I have been doing the Purify kit 1-2 times a year for the last 7 years. I love the energy I have, clear headed, whiter eyes, better sleep, and I lost 2.2kg. In the 2nd week my energy levels were fantastic - I know that my microbiome is stronger and healthier - it’s also a great way to get on a healthier eating plan with the recommended foods. What a fantastic programme that everyone should try to support their gut microbiome."

As with any nutritional product, please consult your physician before use, especially if pregnant, lactating, or have a known medical condition. Our products are not intended to diagnose, treat, or prevent any disease.